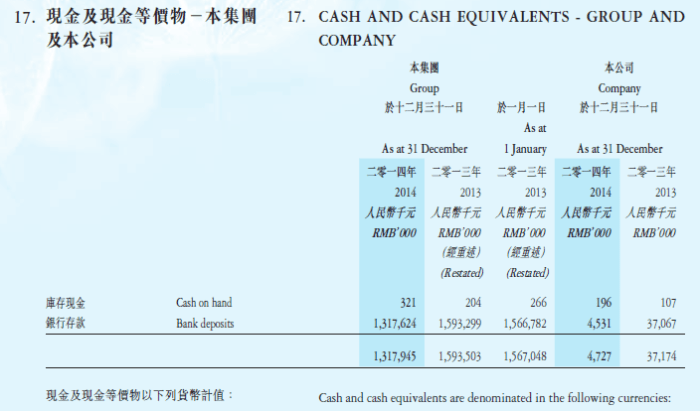

Prior years’ financial statements are restated under the new standards to ensure consistency and comparability of financial information over time. This process involves revising previously issued financial statements to reflect changes in accounting principles, corrections of errors, or changes in estimates.

Understanding the reasons for and implications of prior year restatements is crucial for stakeholders to make informed decisions based on accurate and reliable financial information.

Restating financial statements can significantly impact a company’s financial position and performance. It is essential to disclose these restatements transparently and provide clear explanations to maintain investor confidence and ensure the integrity of financial reporting.

Prior Year Restatements: Definition and Purpose

Prior year restatements are revisions to previously issued financial statements that correct errors or reflect changes in accounting principles or estimates. Companies may need to restate prior years’ financial statements to ensure that they are accurate and reliable.

Reasons for Restatements, Prior years’ financial statements are restated under the

*

-*Corrections of errors

Material errors in the original financial statements, such as miscalculations or misclassifications.

-

-*Changes in accounting principles

Adoption of new accounting standards or changes in the application of existing standards.

-*Changes in estimates

Revisions to estimates used in the preparation of the financial statements, such as depreciation rates or warranty reserves.

Accounting Standards and Regulations

Prior year restatements are governed by accounting standards and regulations set by the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB).

FASB and IASB

* FASB sets accounting standards for companies in the United States.

IASB sets accounting standards for companies in many countries outside the United States.

Types of Restatements

Prior year restatements can be classified into three main types:

Corrections of Errors

* Material errors discovered after the financial statements have been issued.

Examples

Reclassification of expenses, correction of mathematical errors.

Changes in Accounting Principles

* Adoption of new accounting standards or changes in the application of existing standards.

Examples

Adoption of a new depreciation method, change in inventory valuation method.

Changes in Estimates

* Revisions to estimates used in the preparation of the financial statements.

Examples

Revision of warranty reserves, adjustment of depreciation rates.

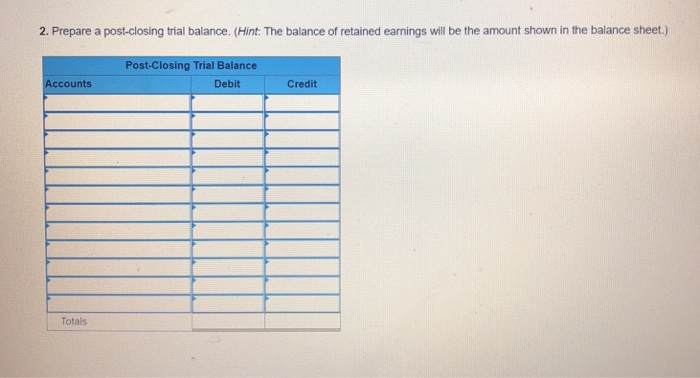

Impact on Financial Statements: Prior Years’ Financial Statements Are Restated Under The

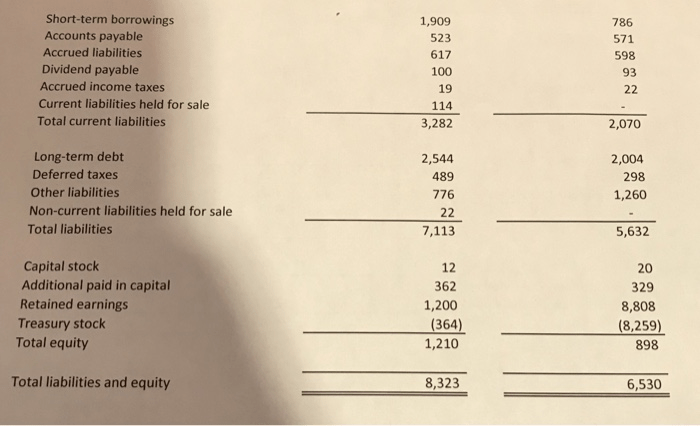

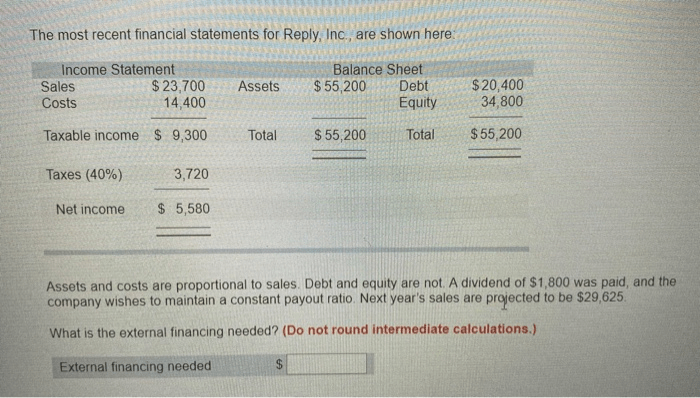

Prior year restatements can have a significant impact on the current financial statements.

Income Statement

* Restatements may affect revenues, expenses, and net income.

Balance Sheet

* Restatements may affect assets, liabilities, and equity.

Statement of Cash Flows

* Restatements may affect cash flow from operating, investing, and financing activities.

Disclosure Requirements

Companies are required to disclose prior year restatements in their financial statements.

Importance of Disclosure

* Transparency and full disclosure are essential for investors and other users of financial statements.

Disclosures help users understand the reasons for restatements and assess their impact on the financial statements.

Audit Implications

Auditors play a crucial role in reviewing and evaluating prior year restatements.

Auditor’s Responsibility

* Ensure the accuracy and reliability of the financial statements.

Evaluate the reasonableness of the restatements and the adequacy of the disclosures.

Essential Questionnaire

What are the reasons for prior year restatements?

Prior year restatements can be due to corrections of errors, changes in accounting principles, or changes in estimates.

How do prior year restatements impact financial statements?

Restatements can affect the income statement, balance sheet, and statement of cash flows, potentially altering a company’s financial position and performance.

What are the disclosure requirements for prior year restatements?

Companies must disclose prior year restatements transparently, providing clear explanations and quantifying the impact on financial statements.